Chapter 16 Assignment 6: Entry and Exit Analysis

16.1 Simulate data

In this assignment, we consider a Berry-type entry model. Suppose that there are \(M\) markets indexed by \(m = 1, \cdots, M\). In each market, there are \(N_m\) potential entrants such that \(N_m \le \overline{N}\). Let \(x_m\) be the \(K\) dimensional market attributes and \(z_{im}\) be the \(L\) dimensional potential entrant attributes. The size of Monte Carlo simulations in the estimation is \(R\).

A random number generation inside %dopar% is not reproducible. Therefore, we use package doRNG to perform reproducible foreach parallel.

- Set the constants as follows:

registerDoParallel()

# register doRNG backend

registerDoRNG()

# set the seed

set.seed(1)

# number of markets

M <- 100

# the upper bound of the number of potential entrants

N <- 10

# the dimension of market attributes

K <- 2

# the dimension of potential entrant attributes

L <- 2

# the number of Monte Carlo simulations

R <- 100The payoff of entrant \(i\) in market \(m\) is: \[ \pi_{im}(y_m) = x_m'\beta - \delta \ln \left(\sum_{i = 1}^{N_m} y_{im}\right) + z_{im}'\alpha + \sqrt{1 - \rho^2} \nu_{im} + \rho \epsilon_{m}, \] where \(y_{im} \in \{0, 1\}\) is the indicator for entrant \(i\) in market \(m\) to enter the market, and \(\nu_{im}\) and \(\epsilon_m\) are entrant- and market-specific idiosyncratic shocks that are drawn from an i.i.d. standard normal distribution. In each market, all the attributes and idiosyncratic shocks are observed by the potential entrants. \(N_m\), \(x_m\), \(z_{im}\), and \(y_m\) are observed to econometrician but \(\nu_{im}\) and \(\epsilon_m\) are not.

- Set the parameters as follows:

## [1] 0.6264538 0.1836433## [1] 0.8356286 1.5952808## [1] 1## [1] 0.3295078- Draw exogenous variables as follows:

## [1] 3 1 5 5 10 6 10 7 9 5 5 9 9 5 5 2 10 9 1 4 3 6 10 10 6

## [26] 4 4 10 9 7 6 9 8 9 7 8 6 10 7 3 10 6 8 2 2 6 6 1 3 3

## [51] 8 6 7 6 8 7 1 4 8 9 9 7 4 7 6 1 5 6 1 9 7 7 3 6 2

## [76] 10 10 7 3 2 10 1 10 10 8 10 5 7 8 5 6 8 1 3 10 3 1 6 6 4# market attributes

X <-

matrix(

rnorm(

M * K,

x_mu,

x_sd

),

nrow = M

)

colnames(X) <- paste("x", 1:K, sep = "_")

X[1:10, ]## x_1 x_2

## [1,] -0.70600620 -2.6939703

## [2,] 0.59446415 3.9516867

## [3,] 4.53426099 1.6597744

## [4,] -3.57070040 -3.4017501

## [5,] 2.78183856 2.5630682

## [6,] 1.99885111 0.5237362

## [7,] 4.18929951 5.3937619

## [8,] 0.08744823 -1.2982460

## [9,] 2.11005643 -0.2906353

## [10,] 1.80129637 -1.7783285# entrant attributes

Z <-

foreach (

m = 1:M

) %dorng% {

Z_m <-

matrix(

rnorm(

E[m] * L,

z_mu,

z_sd

),

nrow = E[m]

)

colnames(Z_m) <- paste("z", 1:L, sep = "_")

return(Z_m)

}

Z[[1]]## z_1 z_2

## [1,] -2.3581574 -7.334507

## [2,] -0.4604547 3.771050

## [3,] 2.7599294 4.610126## [1] -1.1131230 0.6169665 0.5134937 0.3694591 1.7238941 -0.2061446

## [7] -1.3141951 0.0634741 -0.2319775 0.6350603# unobserved entrant attributes

NU <-

foreach (

m = 1:M

) %dorng% {

NU_m <-

matrix(

rnorm(E[m]),

nrow = E[m]

)

return(NU_m)

}

NU[[1]]## [,1]

## [1,] 0.3934210

## [2,] 0.2303175

## [3,] -0.6046126- Write a function

compute_payoff(y_m, X_m, Z_m, EP_m, NU_m, beta, alpha, delta, rho)that returns the vector of payoffs of the potential entrants when the vector of entry decisions isy_m.

m <- 1

N_m <- dim(Z[[m]])[1]

y_m <- as.matrix(rep(1, N_m))

y_m[length(y_m)] <- 0

X_m <- X[m, , drop = FALSE]

Z_m <- Z[[m]]

EP_m <- EP[m, , drop = FALSE]

NU_m <- NU[[m]]

compute_payoff(

y_m = y_m,

X_m = X_m,

Z_m = Z_m,

EP_m = EP_m,

NU_m = NU_m,

beta = beta,

alpha = alpha,

delta = delta,

rho = rho

)## [,1]

## [1,] -15.296633

## [2,] 3.851629

## [3,] 0.000000- Assume that the order of entry is predetermined. Assume that the potential entrants sequentially decide entry according to the order of the payoff excluding the competitive effects, i.e.:

\[

x_m'\beta + z_{im}'\alpha + \sqrt{1 - \rho^2} \nu_{im} + \rho \epsilon_{m}.

\]

Write a function

compute_order_sequential_entry(X_m, Z_m, EP_m, NU_m, beta, alpha, rho)that returns the order of entry of the potential entrants by the baseline payoff. Note that if the less profitable entrant finds it profitable to enter then the more profitable entrant still finds it profitable to enter. Then write a functioncompute_sequential_entry(X_m, Z_m, EP_m, NU_m, beta, alpha, delta, rho)that returns the equilibrium vector of entry at a market. To do so, you must find at which entrant the payoff becomes negative for the first time.

compute_order_sequential_entry(

X_m = X_m,

Z_m = Z_m,

EP_m = EP_m,

NU_m = NU_m,

beta = beta,

alpha = alpha,

rho = rho

)## [1] 3 2 1compute_sequential_entry(

X_m = X_m,

Z_m = Z_m,

EP_m = EP_m,

NU_m = NU_m,

beta = beta,

alpha = alpha,

delta = delta,

rho = rho

)## [,1]

## [1,] 0

## [2,] 1

## [3,] 1- Next, assume \(\rho = 0\). Assume that potential entrants simultaneously decide entry. Write a function

compute_best_response_simultaneous_entrythat returns the best response function of the potential participant given an entry decision. Then, write a functioncompute_simultaneous_entry(X_m, Z_m, EP_m, NU_m, beta, alpha, delta)that returns the equilibrium vector of entry at a market, given an initial entry decision where all firms decide to enter. To do so, you need to compute the best response given other firm’s entry decisions, and iterate the best response mapping until convergence.

compute_best_response_simultaneous_entry(

y_m = y_m,

X_m = X_m,

Z_m = Z_m,

EP_m = EP_m,

NU_m = NU_m,

beta = beta,

alpha = alpha,

delta = delta

) ## [,1]

## [1,] 0

## [2,] 1

## [3,] 1compute_simultaneous_entry(

X_m = X_m,

Z_m = Z_m,

EP_m = EP_m,

NU_m = NU_m,

beta = beta,

alpha = alpha,

delta = delta

)## [,1]

## [1,] 0

## [2,] 1

## [3,] 1- Write a function

compute_sequential_entry_across_markets(X, Z, EP, NU, beta, alpha, delta, rho)compute the equilibrium entry vectors under the assumption of sequential entry. The output should be a list of entry vectors across markets. Write a function to compute the equilibrium payoffs across markets,compute_payoff_across_markets(Y, X, Z, EP, NU, beta, alpha, delta, rho)and check that the payoffs under the equilibrium entry vectors are non-negative. Otherwise, there are some bugs in the code.

Y_sequential <-

compute_sequential_entry_across_markets(

X = X,

Z = Z,

EP = EP,

NU = NU,

beta = beta,

alpha = alpha,

delta = delta,

rho = rho

)

Y_sequential[[1]]## [,1]

## [1,] 0

## [2,] 1

## [3,] 1## [,1]

## [1,] 1

## [2,] 1

## [3,] 1

## [4,] 0payoff_sequential <-

compute_payoff_across_markets(

Y = Y_sequential,

X = X,

Z = Z,

EP = EP,

NU = NU,

beta = beta,

alpha = alpha,

delta = delta,

rho = rho

)

min(unlist(payoff_sequential))## [1] 0- Write a function

compute_simultaneous_entry_across_markets(X, Z, EP, NU, beta, alpha, delta, rho = 0)compute the equilibrium entry vectors under the assumption of simultaneous entry. The output should be a list of entry vectors across markets. Check that the payoffs under the equilibrium entry vectors are non-negative. Otherwise, there are some bugs in the code. I also recommend to write this function with

# compute simultaneous entry across markets

Y_simultaneous <-

compute_simultaneous_entry_across_markets(

X = X,

Z = Z,

EP = EP,

NU = NU,

beta = beta,

alpha = alpha,

delta = delta)

Y_simultaneous[[1]]## [,1]

## [1,] 0

## [2,] 1

## [3,] 1## [,1]

## [1,] 1

## [2,] 1

## [3,] 1

## [4,] 0payoff_simultaneous <-

compute_payoff_across_markets(

Y = Y_simultaneous,

X = X,

Z = Z,

EP = EP,

NU = NU,

beta = beta,

alpha = alpha,

delta = delta,

rho = 0

)

min(unlist(payoff_simultaneous))## [1] 016.2 Estimate the parameters

We estimate the parameters by matching the actual and predicted number of entrants in each market. To do so, we simulate the model for \(R\) times. Under the assumption of the sequential entry, we can uniquely predict the equilibrium identify of the entrants. So, we consider the following objective function: \[ \frac{1}{RM}\sum_{r = 1}^R \sum_{m = 1}^M \left[\sum_{i = 1}^{N_m}|y_{im} - y_{im}^{(r)}| \right]^2, \] where \(y_{im}^{(r)}\) is the entry decision in \(r\)-th simulation. On the other hand, under the assumption of the simultaneous entry, we can only uniquely predict the equilibrium number of the entrants. So, we consider the following objective function: \[ \frac{1}{RM}\sum_{r = 1}^R \sum_{m = 1}^M \left[\sum_{i = 1}^{N_m}(y_{im} - y_{im}^{(r)}) \right]^2, \]

- Draw \(R\) unobserved shocks:

set.seed(1)

# unobserved market attributes

EP_mc <-

foreach (

r = 1:R

) %dorng% {

EP <-

matrix(

rnorm(M),

nrow = M

)

return(EP)

}

head(EP_mc[[1]])## [,1]

## [1,] 0.74570967

## [2,] -0.07155828

## [3,] -0.03724045

## [4,] 0.69069075

## [5,] -0.71328829

## [6,] 0.01630815# unobserved entrant attributes

NU_mc <-

foreach (

r = 1:R

) %dorng% {

NU <-

foreach (

m = 1:M

) %do% {

NU_m <-

matrix(

rnorm(E[m]),

nrow = E[m]

)

return(NU_m)

}

return(NU)

}

NU_mc[[1]][[1]]## [,1]

## [1,] 0.2226442

## [2,] -1.1481303

## [3,] -0.1690491- Write a function

compute_monte_carlo_sequential_entry(X, Z, EP_mc, NU_mc, beta, alpha, delta, rho)that returns the Monte Carlo simulation. Then, write functioncompute_objective_sequential_entry(Y, X, Z, EP_mc, NU_mc, theta)that callscompute_monte_carlo_sequential_entryand returns the value of the objective function given data and parameters under the assumption of sequential entry.

# sequential entry

theta <-

theta_sequential <-

c(

beta,

alpha,

delta,

rho

)

Y <- Y_sequential

# compute monte carlo simulations

Y_mc <-

compute_monte_carlo_sequential_entry(

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc,

beta = beta,

alpha = alpha,

delta = delta,

rho = rho

)

Y_mc[[1]][[1]]## [,1]

## [1,] 0

## [2,] 1

## [3,] 1# compute objective function

compute_objective_sequential_entry(

Y = Y,

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc,

theta = theta

)## [1] 0.34- Write a function

compute_objective_simultaneous_entry(Y, X, Z, EP_mc, NU_mc, theta)that returns the value of the objective function given data and parameters under the assumption of simultaneous entry.

# simultaneous entry

theta <-

theta_simultaneous <-

c(

beta,

alpha,

delta

)

Y <- Y_simultaneous

# compute monte carlo simulations

Y_mc <-

compute_monte_carlo_simultaneous_entry(

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc,

beta = beta,

alpha = alpha,

delta = delta

)

Y_mc[[1]][[1]]## [,1]

## [1,] 0

## [2,] 1

## [3,] 1# compute objective function

compute_objective_simultaneous_entry(

Y = Y,

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc,

theta = theta

)## [1] 0.2456- Check the value of the objective function around the true parameter under the assumption of the sequential entry.

# sequential entry

theta <-

theta_sequential <-

c(

beta,

alpha,

delta,

rho

)

Y <- Y_sequential

model <- compute_sequential_entry_across_markets

label <- c(

paste("\\beta_", 1:K, sep = ""),

paste("\\alpha_", 1:L, sep = ""),

"\\delta",

"\\rho"

)

label <- paste("$", label, "$", sep = "")

# compute the graph

graph <-

foreach (

i = 1:length(theta)

) %do% {

theta_i <- theta[i]

theta_i_list <- theta_i * seq(0.5, 1.5, by = 0.1)

objective_i <-

foreach (

j = 1:length(theta_i_list),

.combine = "rbind"

) %do% {

theta_ij <- theta_i_list[j]

theta_j <- theta

theta_j[i] <- theta_ij

objective_ij <-

compute_objective_sequential_entry(

Y,

X,

Z,

EP_mc,

NU_mc,

theta_j

)

return(objective_ij)

}

df_graph <-

data.frame(

x = theta_i_list,

y = objective_i

)

g <-

ggplot(

data = df_graph,

aes(

x = x,

y = y

)

) +

geom_point() +

geom_vline(

xintercept = theta_i,

linetype = "dotted"

) +

ylab("objective function") +

xlab(TeX(label[i])) +

theme_classic()

return(g)

}

saveRDS(

graph,

file = "lecture/data/a6/graph_sequential.rds" %>% here::here()

)## [[1]]

##

## [[2]]

##

## [[3]]

##

## [[4]]

##

## [[5]]

##

## [[6]]

- Check the value of the objective function around the true parameter under the assumption of the simultaneous entry.

# simultaneous entry

theta <-

theta_simultaneous <-

c(

beta,

alpha,

delta

)

Y <- Y_simultaneous

model <- compute_simultaneous_entry_across_markets

label <- c(

paste("\\beta_", 1:K, sep = ""),

paste("\\alpha_", 1:L, sep = ""),

"\\delta"

)

label <- paste("$", label, "$", sep = "")

# compute the graph

graph <-

foreach (

i = 1:length(theta)

) %do% {

theta_i <- theta[i]

theta_i_list <- theta_i * seq(0.5, 1.5, by = 0.1)

objective_i <-

foreach (

j = 1:length(theta_i_list),

.combine = "rbind"

) %do% {

theta_ij <- theta_i_list[j]

theta_j <- theta

theta_j[i] <- theta_ij

objective_ij <-

compute_objective_simultaneous_entry(

Y,

X,

Z,

EP_mc,

NU_mc,

theta_j

)

return(objective_ij)

}

df_graph <-

data.frame(

x = theta_i_list,

y = objective_i

)

g <-

ggplot(

data = df_graph,

aes(

x = x,

y = y

)

) +

geom_point() +

geom_vline(

xintercept = theta_i,

linetype = "dotted"

) +

ylab("objective function") +

xlab(TeX(label[i])) +

theme_classic()

return(g)

}

saveRDS(

graph,

file = "lecture/data/a6/graph_simultaneous.rds" %>% here::here()

)## [[1]]

##

## [[2]]

##

## [[3]]

##

## [[4]]

##

## [[5]]

- Estimate the parameters under the assumption of the sequential entry.

Y <- Y_sequential

result_sequential <-

optim(

par = theta,

fn = compute_objective_sequential_entry,

method = "Nelder-Mead",

Y = Y,

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc

)

saveRDS(

result_sequential,

file = "lecture/data/a6/estimate_sequential.rds" %>% here::here()

)result_sequential <-

readRDS(

file = "lecture/data/a6/estimate_sequential.rds" %>% here::here()

)

result_sequential## $par

## [1] 0.7761887 0.2204343 1.0747480 2.0150864 0.9116741 0.2875538

##

## $value

## [1] 0.2638

##

## $counts

## function gradient

## 233 NA

##

## $convergence

## [1] 0

##

## $message

## NULL## actual estimate

## 1 0.6264538 0.7761887

## 2 0.1836433 0.2204343

## 3 0.8356286 1.0747480

## 4 1.5952808 2.0150864

## 5 1.0000000 0.9116741

## 6 0.3295078 0.2875538- Estimate the parameters under the assumption of the simultaneous entry. Set the lower bound for \(\delta\) at 0.

Y <- Y_simultaneous

result_simultaneous <-

optim(

par = theta,

fn = compute_objective_simultaneous_entry,

method = "Nelder-Mead",

Y = Y,

X = X,

Z = Z,

EP_mc = EP_mc,

NU_mc = NU_mc)

saveRDS(

result_simultaneous,

file = "lecture/data/a6/estimate_simultaneous.rds" %>% here::here()

)result_simultaneous <-

readRDS(

file = "lecture/data/a6/estimate_simultaneous.rds" %>% here::here()

)

result_simultaneous## $par

## [1] 0.7347919 0.2151107 0.9427083 1.7495325 0.9448480

##

## $value

## [1] 0.2158

##

## $counts

## function gradient

## 151 NA

##

## $convergence

## [1] 0

##

## $message

## NULL## actual estimate

## 1 0.6264538 0.7347919

## 2 0.1836433 0.2151107

## 3 0.8356286 0.9427083

## 4 1.5952808 1.7495325

## 5 1.0000000 0.944848016.3 Conduct counterfactual simulations

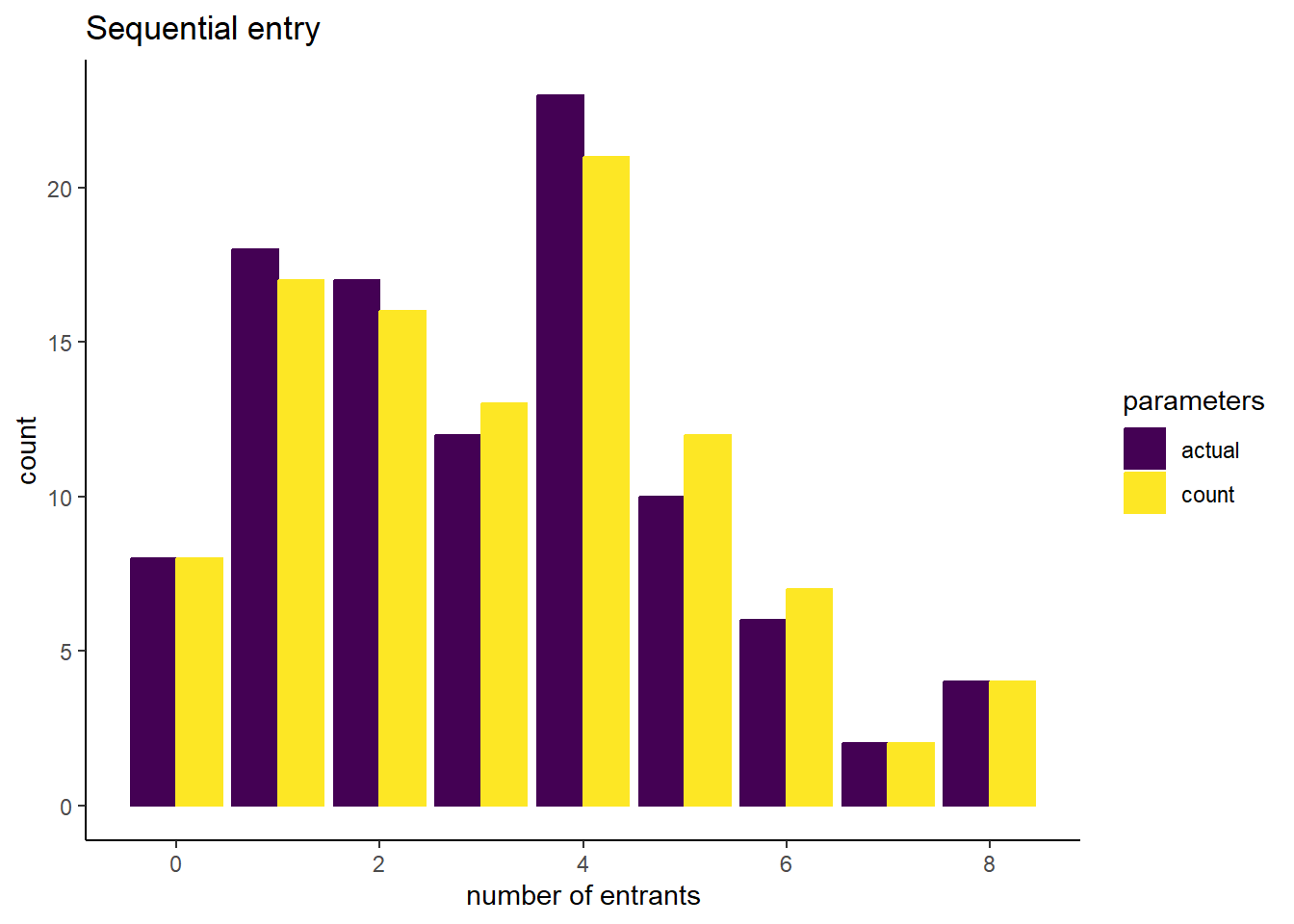

- Fix the first draw of the Monte Carlo shocks. Suppose that the competitive effect becomes mild, i.e. \(\delta\) is changed to 0.5. Under these shocks, compute the equilibrium number of entrants across markets and plot the histogram with the estimated and counterfactual parameters. Conduct this analysis under the assumptions of sequential and simultaneous entry.