Chapter 18 Assignment 8: Dynamic Game

18.1 Simulate data

Suppose that there are \(m = 1, \cdots, M\) markets and in each market there are \(i = 1, \cdots, N\) firms and each firm makes decisions for \(t = 1, \cdots, \infty\). In the following, I suppress the index of market, \(m\). We solve the model under the infinite-horizon assumption, but generate data only for \(t = 1, \cdots, T\). There are \(L = 5\) state \(\{1, 2, 3, 4, 5\}\) states for each firm. Each firm can choose \(K + 1 = 2\) actions \(\{0, 1\}\). Thus, \(m_a := (K + 1)^N\) and \(m_s = L^N\). Let \(a_i\) and \(s_i\) be firm \(i\)’s action and state and \(a\) and \(s\) are vectors of individual actions and states.

The mean period payoff to firm \(i\) is: \[ \pi_i(a, s) := \tilde{\pi}(a_i, s_i, \overline{s}) := \alpha \ln s_i - \eta \ln s_i \sum_{j \neq i} \ln s_j - \beta a_i, \] where \(\alpha, \beta, \eta> 0\), and \(\alpha > \eta\). The term \(\eta\) means that the returns to investment decreases as rival’s average state profile improves. The period payoff is: \[ \tilde{\pi}(a_i, s_i, \overline{s})+ \epsilon_i(a_i), \] and \(\epsilon_i(a_i)\) is an i.i.d. type-I extreme random variable that is independent of all the other variables.

At the beginning of each period, the state \(s\) is realized and publicly observed. Then choice-specific shocks \(\epsilon_i(a_i), a_i = 0, 1\) are realized and privately observed by firm \(i = 1, \cdots, N\). Then each firm simultaneously chooses her action. Then, the game moves to next period.

State transition is independent across firms conditional on individual state and action.

Suppose that \(s_i > 1\) and \(s_i < L\). If \(a_i = 0\), the state stays at the same state with probability \(1 - \kappa\) and moves down by 1 with probability \(\kappa\). If \(a = 1\), the state moves up by 1 with probability \(\gamma\), moves down by 1 with probability \(\kappa\), and stays at the same with probability \(1 - \kappa - \gamma\).

Suppose that \(s_i = 1\). If \(a_i = 0\), the state stays at the same state with probability 1. If \(a_i = 1\), the state moves up by 1 with probability \(\gamma\) and stays at the same with probability \(1 - \gamma\).

Suppose that \(s_i = L\). If \(a_i = 0\), the state stays at the same state with probability \(1 - \kappa\) and moves down by 1 with probability \(\kappa\). If \(a = 1\), the state moves down by 1 with probability \(\kappa\), and stays at the same with probability \(1 - \kappa\).

The mean period profit is summarized in \(\Pi\) as:

\[ \Pi := \begin{pmatrix} \pi(1, 1)\\ \vdots\\ \pi(m_a, 1)\\ \vdots \\ \pi(1, m_s)\\ \vdots\\ \pi(m_a, m_s)\\ \end{pmatrix} \]

The transition law is summarized in \(G\) as:

\[ g(a, s, s') := \mathbb{P}\{s_{t + 1} = s'|s_t = s, a_t = a\}, \]

\[ G := \begin{pmatrix} g(1, 1, 1) & \cdots & g(1, 1, m_s)\\ \vdots & & \vdots \\ g(m_a, 1, 1) & \cdots & g(m_a, 1, m_s)\\ & \vdots & \\ g(1, m_s, 1) & \cdots & g(1, m_s, m_s)\\ \vdots & & \vdots \\ g(m_a, m_s, 1) & \cdots & g(m_a, m_s, m_s)\\ \end{pmatrix}. \] The discount factor is denoted by \(\delta\). We simulate data for \(M\) markets with \(N\) firms for \(T\) periods.

- Set constants and parameters as follows:

# set seed

set.seed(1)

# set constants

L <- 5

K <- 1

T <- 100

N <- 3

M <- 1000

lambda <- 1e-10

# set parameters

alpha <- 1

eta <- 0.3

beta <- 2

kappa <- 0.1

gamma <- 0.6

delta <- 0.95- Write a function

compute_action_state_space(K, L, N)that returns a data frame for action and state space. Returned objects are list of data frameAandS. InA, columnkis the index of an action profile,iis the index of a firm, andais the action of the firm. InS, columnlis the index of an state profile,iis the index of a firm, andsis the state of the firm.

## # A tibble: 6 × 3

## k i a

## <int> <int> <int>

## 1 1 1 0

## 2 1 2 0

## 3 1 3 0

## 4 2 1 1

## 5 2 2 0

## 6 2 3 0## # A tibble: 6 × 3

## k i a

## <int> <int> <int>

## 1 7 1 0

## 2 7 2 1

## 3 7 3 1

## 4 8 1 1

## 5 8 2 1

## 6 8 3 1## # A tibble: 6 × 3

## l i s

## <int> <int> <int>

## 1 1 1 1

## 2 1 2 1

## 3 1 3 1

## 4 2 1 2

## 5 2 2 1

## 6 2 3 1## # A tibble: 6 × 3

## l i s

## <int> <int> <int>

## 1 124 1 4

## 2 124 2 5

## 3 124 3 5

## 4 125 1 5

## 5 125 2 5

## 6 125 3 5## [1] 8## [1] 125- Write function

compute_PI_game(alpha, beta, eta, A, S)that returns a list of \(\Pi_i\).

## [,1]

## [1,] 0

## [2,] 0

## [3,] 0

## [4,] 0

## [5,] -2

## [6,] -2## [1] TRUE- Write function

compute_G_game(g, A, S)that converts an individual transition probability matrix into a joint transition probability matrix \(G\).

G_marginal <-

compute_G(

kappa = kappa,

gamma = gamma,

L = L,

K = K

)

G <-

compute_G_game(

G_marginal = G_marginal,

A = A,

S = S

)

head(G)## 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

## [1,] 1.00 0.00 0 0 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [2,] 0.40 0.60 0 0 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [3,] 0.40 0.00 0 0 0 0.60 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [4,] 0.16 0.24 0 0 0 0.24 0.36 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [5,] 0.40 0.00 0 0 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [6,] 0.16 0.24 0 0 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

## [1,] 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [2,] 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [3,] 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [4,] 0 0.00 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [5,] 0 0.60 0.00 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [6,] 0 0.24 0.36 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

## [1,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [2,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [3,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [4,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [5,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [6,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97

## [1,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [2,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [3,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [4,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [5,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [6,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116

## [1,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [2,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [3,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [4,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [5,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## [6,] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

## 117 118 119 120 121 122 123 124 125

## [1,] 0 0 0 0 0 0 0 0 0

## [2,] 0 0 0 0 0 0 0 0 0

## [3,] 0 0 0 0 0 0 0 0 0

## [4,] 0 0 0 0 0 0 0 0 0

## [5,] 0 0 0 0 0 0 0 0 0

## [6,] 0 0 0 0 0 0 0 0 0## [1] TRUE## [1] TRUEThe ex-ante-value function for a firm is written as a function of a conditional choice probability as follows: \[ \varphi_i^{(\theta_1, \theta_2)}(p) := [I - \delta \Sigma(p) G]^{-1}[\Sigma(p)\Pi_i + D_i(p)], \] where \(\theta_1 = (\alpha, \beta, \eta)\) and \(\theta_2 = (\kappa, \gamma)\), \(p_i(a_i|s)\) is the probability that firm \(i\) choose action \(a_i\) when the state profile is \(s\), and: \[ p(a|s) = \prod_{i = 1}^N p_i(a_i|s), \]

\[ p(s) = \begin{pmatrix} p(1|s) \\ \vdots \\ p(m_a|s) \end{pmatrix}, \]

\[ p = \begin{pmatrix} p(1)\\ \vdots\\ p(m_s) \end{pmatrix}, \]

\[ \Sigma(p) = \begin{pmatrix} p(1)' & & \\ & \ddots & \\ & & p(L)' \end{pmatrix} \]

and:

\[ D_i(p) = \begin{pmatrix} \sum_{k = 0}^K \mathbb{E}\{\epsilon_i^k|a_i = k, 1\}p_i(a_i = k|1)\\ \vdots\\ \sum_{k = 0}^K \mathbb{E}\{\epsilon_i^k|a_i = k, m_s\}p_i(a_i = k|m_s) \end{pmatrix}. \]

- Write a function

initialize_p_marginal(A, S)that defines an initial marginal condition choice probability. In the outputp_marginal,pis the probability for firmito take actionaconditional on the state profile beingl. Next, write a functioncompute_p_joint(p_marginal, A, S)that computes a corresponding joint conditional choice probability from a marginal conditional choice probability. In the outputp_joint,pis the joint probability that firms take action profilekcondition on the state profile beingl. Finally, write a functioncompute_p_marginal(p_joint, A, S)that compute a corresponding marginal conditional choice probability from a joint conditional choice probability.

# define a conditional choice probability for each firm

p_marginal <-

initialize_p_marginal(

A = A,

S = S

)

p_marginal## # A tibble: 750 × 4

## i l a p

## <int> <int> <int> <dbl>

## 1 1 1 0 0.5

## 2 1 1 1 0.5

## 3 1 2 0 0.5

## 4 1 2 1 0.5

## 5 1 3 0 0.5

## 6 1 3 1 0.5

## 7 1 4 0 0.5

## 8 1 4 1 0.5

## 9 1 5 0 0.5

## 10 1 5 1 0.5

## # ℹ 740 more rows## [1] TRUE# compute joint conditional choice probability from marginal probability

p_joint <-

compute_p_joint(

p_marginal = p_marginal,

A = A,

S = S

)

p_joint## # A tibble: 1,000 × 3

## l k p

## <int> <int> <dbl>

## 1 1 1 0.125

## 2 1 2 0.125

## 3 1 3 0.125

## 4 1 4 0.125

## 5 1 5 0.125

## 6 1 6 0.125

## 7 1 7 0.125

## 8 1 8 0.125

## 9 2 1 0.125

## 10 2 2 0.125

## # ℹ 990 more rows## [1] TRUE# compute marginal conditional choice probability from joint probability

p_marginal_2 <-

compute_p_marginal(

p_joint = p_joint,

A = A,

S = S

)

max(abs(p_marginal - p_marginal_2))## [1] 0- Write a function

compute_sigma(p_marginal, A, S)that computes \(\Sigma(p)\) given a joint conditional choice probability. Then, write a functioncompute_D(p_marginal)that returns a list of \(D_i(p)\).

# compute Sigma for ex-ante value function calculation

sigma <-

compute_sigma(

p_marginal = p_marginal,

A = A,

S = S

)

head(sigma)## 6 x 1000 sparse Matrix of class "dgCMatrix"

##

## [1,] 0.125 0.125 0.125 0.125 0.125 0.125 0.125 0.125 . . . .

## [2,] . . . . . . . . 0.125 0.125 0.125 0.125

## [3,] . . . . . . . . . . . .

## [4,] . . . . . . . . . . . .

## [5,] . . . . . . . . . . . .

## [6,] . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . .

## [2,] 0.125 0.125 0.125 0.125 . . . . . . . .

## [3,] . . . . 0.125 0.125 0.125 0.125 0.125 0.125 0.125 0.125

## [4,] . . . . . . . . . . . .

## [5,] . . . . . . . . . . . .

## [6,] . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . .

## [2,] . . . . . . . . . . . .

## [3,] . . . . . . . . . . . .

## [4,] 0.125 0.125 0.125 0.125 0.125 0.125 0.125 0.125 . . . .

## [5,] . . . . . . . . 0.125 0.125 0.125 0.125

## [6,] . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . .

## [5,] 0.125 0.125 0.125 0.125 . . . . . . . . .

## [6,] . . . . 0.125 0.125 0.125 0.125 0.125 0.125 0.125 0.125 .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

##

## [1,] . . . . . . . . . . . . . . . . . . . . . . . . . .

## [2,] . . . . . . . . . . . . . . . . . . . . . . . . . .

## [3,] . . . . . . . . . . . . . . . . . . . . . . . . . .

## [4,] . . . . . . . . . . . . . . . . . . . . . . . . . .

## [5,] . . . . . . . . . . . . . . . . . . . . . . . . . .

## [6,] . . . . . . . . . . . . . . . . . . . . . . . . . .## [1] TRUE## [1] TRUE## [,1]

## [1,] 1.270363

## [2,] 1.270363

## [3,] 1.270363

## [4,] 1.270363

## [5,] 1.270363

## [6,] 1.270363## [1] TRUE- Write a function

compute_exante_value_game(p_marginal, A, S, PI, G, delta)that returns a list of matrices whose \(i\)-th element represents the ex-ante value function given a conditional choice probability for firm \(i\).

# compute ex-ante value funciton for each firm

V <-

compute_exante_value_game(

p_marginal = p_marginal,

A = A,

S = S,

PI = PI,

G = G,

delta = delta

)

head(V[[N]])## 6 x 1 Matrix of class "dgeMatrix"

## [,1]

## l1 10.786330

## l2 10.175982

## l3 9.606812

## l4 9.255459

## l5 9.115332

## l6 10.175982## [1] TRUEThe optimal conditional choice probability is written as a function of an ex-ante value function and a conditional choice probability of others as follows: \[ \Lambda_i^{(\theta_1, \theta_2)}(V_i, p_{-i})(a_i, s) := \frac{\exp\{\sum_{a_{-i}}p_{-i}(a_{-i}|s)[\pi_i(a_i, a_{-i}, s) + \delta \sum_{s'}V_i(s')g(a_i, a_{-i}, s, s')]\}}{\sum_{a_i'}\exp\{\sum_{a_{-i}}p_{-i}(a_{-i}|s)[\pi_i(a_i', a_{-i}, s) + \delta \sum_{s'}V_i(s')g(a_i', a_{-i}, s, s')]\}}, \] where \(V\) is an ex-ante value function.

- Write a function

compute_profile_value_game(V, PI, G, delta, S, A)that returns a data frame that contains information on value function at a state and action profile for each firm. In the outputvalue,iis the index of a firm,lis the index of a state profile,kis the index of an action profile, andvalueis the value for the firm at the state and action profile.

# compute state-action-profile value function

value <-

compute_profile_value_game(

V = V,

PI = PI,

G = G,

delta = delta,

S = S,

A = A

)

value## # A tibble: 3,000 × 4

## i l k value

## <int> <int> <int> <dbl>

## 1 1 1 1 10.2

## 2 1 1 2 9.63

## 3 1 1 3 9.90

## 4 1 1 4 9.13

## 5 1 1 5 9.90

## 6 1 1 6 9.13

## 7 1 1 7 9.55

## 8 1 1 8 8.64

## 9 1 2 1 13.0

## 10 1 2 2 12.1

## # ℹ 2,990 more rows## [1] TRUE- Write a function

compute_choice_value_game(p_marginal, V, PI, G, delta, A, S)that computes a data frame that contains information on a choice-specific value function given an ex-ante value function and a conditional choice probability of others.

# compute choice-specific value function

value <-

compute_choice_value_game(

p_marginal = p_marginal,

V = V,

PI = PI,

G = G,

delta = delta,

A = A,

S = S

)

value## # A tibble: 750 × 4

## i l a value

## <int> <int> <int> <dbl>

## 1 1 1 0 9.90

## 2 1 1 1 9.13

## 3 1 2 0 12.4

## 4 1 2 1 11.4

## 5 1 3 0 14.5

## 6 1 3 1 13.2

## 7 1 4 0 16.0

## 8 1 4 1 14.3

## 9 1 5 0 16.8

## 10 1 5 1 14.8

## # ℹ 740 more rows- Write a function

compute_ccp_game(p_marginal, V, PI, G, delta, A, S)that computes a data frame that contains information on a conditional choice probability given an ex-ante value function and a conditional choice probability of others.

# compute conditional choice probability

p_marginal <-

compute_ccp_game(

p_marginal = p_marginal,

V = V,

PI = PI,

G = G,

delta = delta,

A = A,

S = S

)

p_marginal## # A tibble: 750 × 4

## i l a p

## <int> <int> <int> <dbl>

## 1 1 1 0 0.683

## 2 1 1 1 0.317

## 3 1 2 0 0.734

## 4 1 2 1 0.266

## 5 1 3 0 0.794

## 6 1 3 1 0.206

## 7 1 4 0 0.840

## 8 1 4 1 0.160

## 9 1 5 0 0.881

## 10 1 5 1 0.119

## # ℹ 740 more rows- Write a function

solve_dynamic_game(PI, G, L, K, delta, lambda, A, S)that find the equilibrium conditional choice probability and ex-ante value function by iterating the update of an ex-ante value function and a best-response conditional choice probability. The iteration should stop when \(\max_s|V^{(r + 1)}(s) - V^{(r)}(s)| < \lambda\) with \(\lambda = 10^{-10}\). There is no theoretical guarantee for the convergence.

# solve the dynamic game model

output <-

solve_dynamic_game(

PI = PI,

G = G,

L = L,

K = K,

delta = delta,

lambda = lambda,

A = A,

S = S

)

saveRDS(

output,

file = "lecture/data/a8/equilibrium.rds" %>% here::here()

)output <-

readRDS(

file = "lecture/data/a8/equilibrium.rds" %>% here::here()

)

p_marginal <- output$p_marginal;

head(p_marginal)## # A tibble: 6 × 4

## i l a p

## <int> <int> <int> <dbl>

## 1 1 1 0 0.534

## 2 1 1 1 0.466

## 3 1 2 0 0.545

## 4 1 2 1 0.455

## 5 1 3 0 0.629

## 6 1 3 1 0.371## 6 x 1 Matrix of class "dgeMatrix"

## [,1]

## l1 18.98883

## l2 18.51236

## l3 18.08141

## l4 17.77417

## l5 17.59426

## l6 18.51236# compute joint conitional choice probability

p_joint <-

compute_p_joint(

p_marginal = p_marginal,

A = A,

S = S

);

head(p_joint)## # A tibble: 6 × 3

## l k p

## <int> <int> <dbl>

## 1 1 1 0.152

## 2 1 2 0.133

## 3 1 3 0.133

## 4 1 4 0.116

## 5 1 5 0.133

## 6 1 6 0.116- Write a function

simulate_dynamic_game(p_joint, l, G, N, T, S, A, seed)that simulate the data for a market starting from an initial state for \(T\) periods. The function should accept a value of seed and set the seed at the beginning of the procedure inside the function, because the process is stochastic. To match the generated random numbers, for each period, generate action usingrmultinomand then state usingrmultinom.

# simulate a dynamic game

# set initial state profile

l <- 1

# draw simulation for a firm

seed <- 1

df <-

simulate_dynamic_game(

p_joint = p_joint,

l = l,

G = G,

N = N,

T = T,

S = S,

A = A,

seed = seed

)

df## # A tibble: 300 × 6

## t i l k s a

## <int> <int> <dbl> <dbl> <int> <int>

## 1 1 1 1 4 1 1

## 2 1 2 1 4 1 1

## 3 1 3 1 4 1 0

## 4 2 1 2 1 2 0

## 5 2 2 2 1 1 0

## 6 2 3 2 1 1 0

## 7 3 1 2 5 2 0

## 8 3 2 2 5 1 0

## 9 3 3 2 5 1 1

## 10 4 1 2 3 2 0

## # ℹ 290 more rows- Write a function

simulate_dynamic_decision_across_markets(p_joint, l, G, N, T, M, S, A, seed)that returns simulation data for \(M\) markets. For firm \(m\), set the seed at \(m\)

# simulate data across markets

df <-

simulate_dynamic_decision_across_markets(

p_joint = p_joint,

l = l,

G = G,

N = N,

T = T,

M = M,

S = S,

A = A

)

saveRDS(

df,

file = "lecture/data/a8/df.rds" %>% here::here()

)## # A tibble: 300,000 × 7

## m t i l k s a

## <int> <int> <int> <dbl> <dbl> <int> <int>

## 1 1 1 1 1 4 1 1

## 2 1 1 2 1 4 1 1

## 3 1 1 3 1 4 1 0

## 4 1 2 1 2 1 2 0

## 5 1 2 2 2 1 1 0

## 6 1 2 3 2 1 1 0

## 7 1 3 1 2 5 2 0

## 8 1 3 2 2 5 1 0

## 9 1 3 3 2 5 1 1

## 10 1 4 1 2 3 2 0

## # ℹ 299,990 more rows## m t i l k

## Min. : 1.0 Min. : 1.00 Min. :1 Min. : 1.00 Min. :1.000

## 1st Qu.: 250.8 1st Qu.: 25.75 1st Qu.:1 1st Qu.: 44.00 1st Qu.:1.000

## Median : 500.5 Median : 50.50 Median :2 Median : 75.00 Median :2.000

## Mean : 500.5 Mean : 50.50 Mean :2 Mean : 71.89 Mean :2.497

## 3rd Qu.: 750.2 3rd Qu.: 75.25 3rd Qu.:3 3rd Qu.:102.00 3rd Qu.:4.000

## Max. :1000.0 Max. :100.00 Max. :3 Max. :125.00 Max. :8.000

## s a

## Min. :1.000 Min. :0.0000

## 1st Qu.:2.000 1st Qu.:0.0000

## Median :3.000 Median :0.0000

## Mean :3.288 Mean :0.2131

## 3rd Qu.:5.000 3rd Qu.:0.0000

## Max. :5.000 Max. :1.0000- Write a function

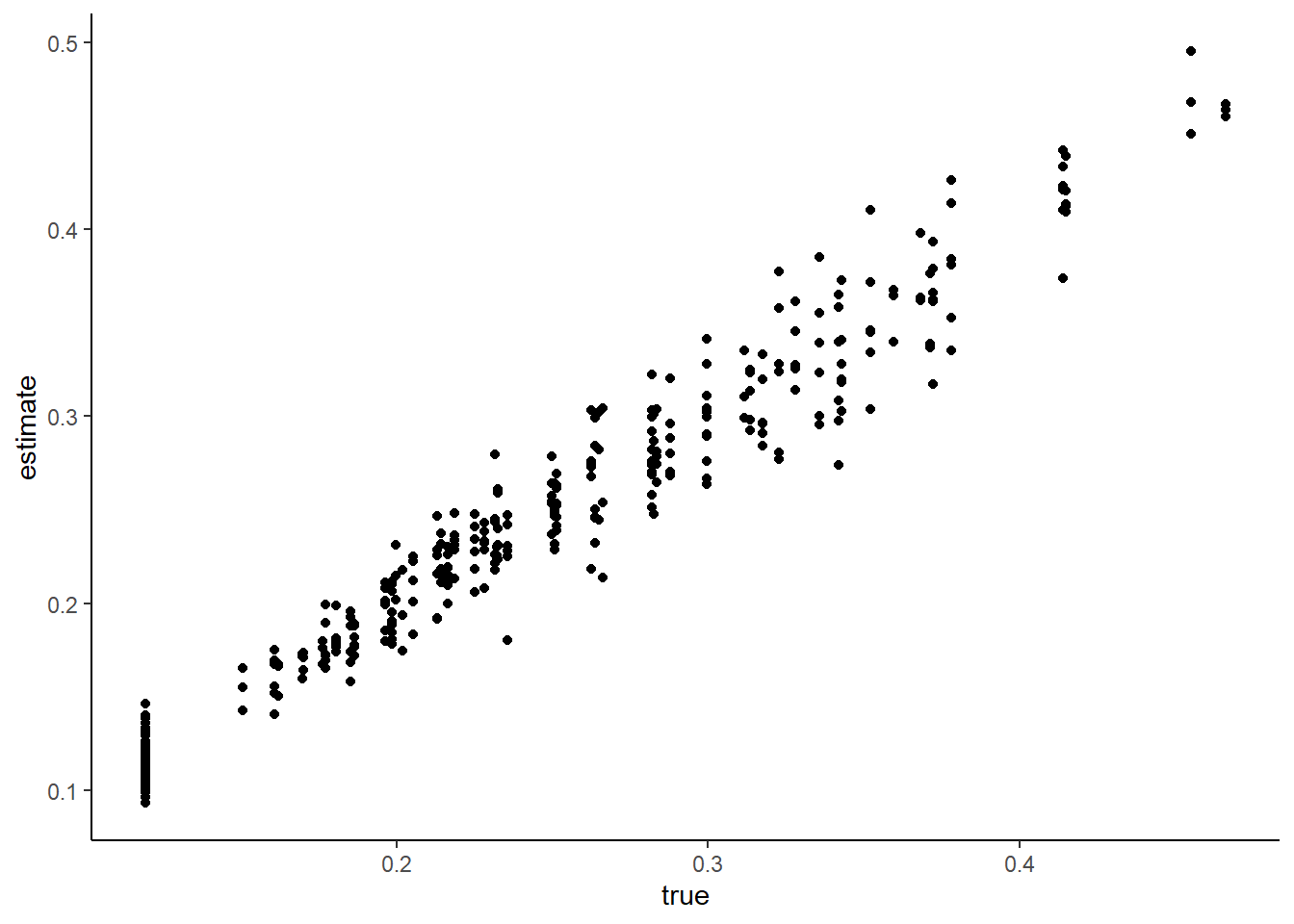

estimate_ccp_marginal_game(df)that returns a non-parametric estimate of the marginal conditional choice probability for each firm in the data. Compare the estimated conditional choice probability and the true conditional choice probability by a bar plot.

# non-parametrically estimate the conditional choice probability

p_marginal_est <-

estimate_ccp_marginal_game(df = df)

check_ccp <-

p_marginal_est %>%

dplyr::rename(estimate = p) %>%

dplyr::left_join(

p_marginal,

by = c(

"i",

"l",

"a"

)

) %>%

dplyr::rename(true = p) %>%

dplyr::filter(a == 1)

ggplot(

data = check_ccp,

aes(

x = true,

y = estimate

)

) +

geom_point() +

labs(fill = "Value") +

xlab("true") +

ylab("estimate") +

theme_classic()

- Write a function

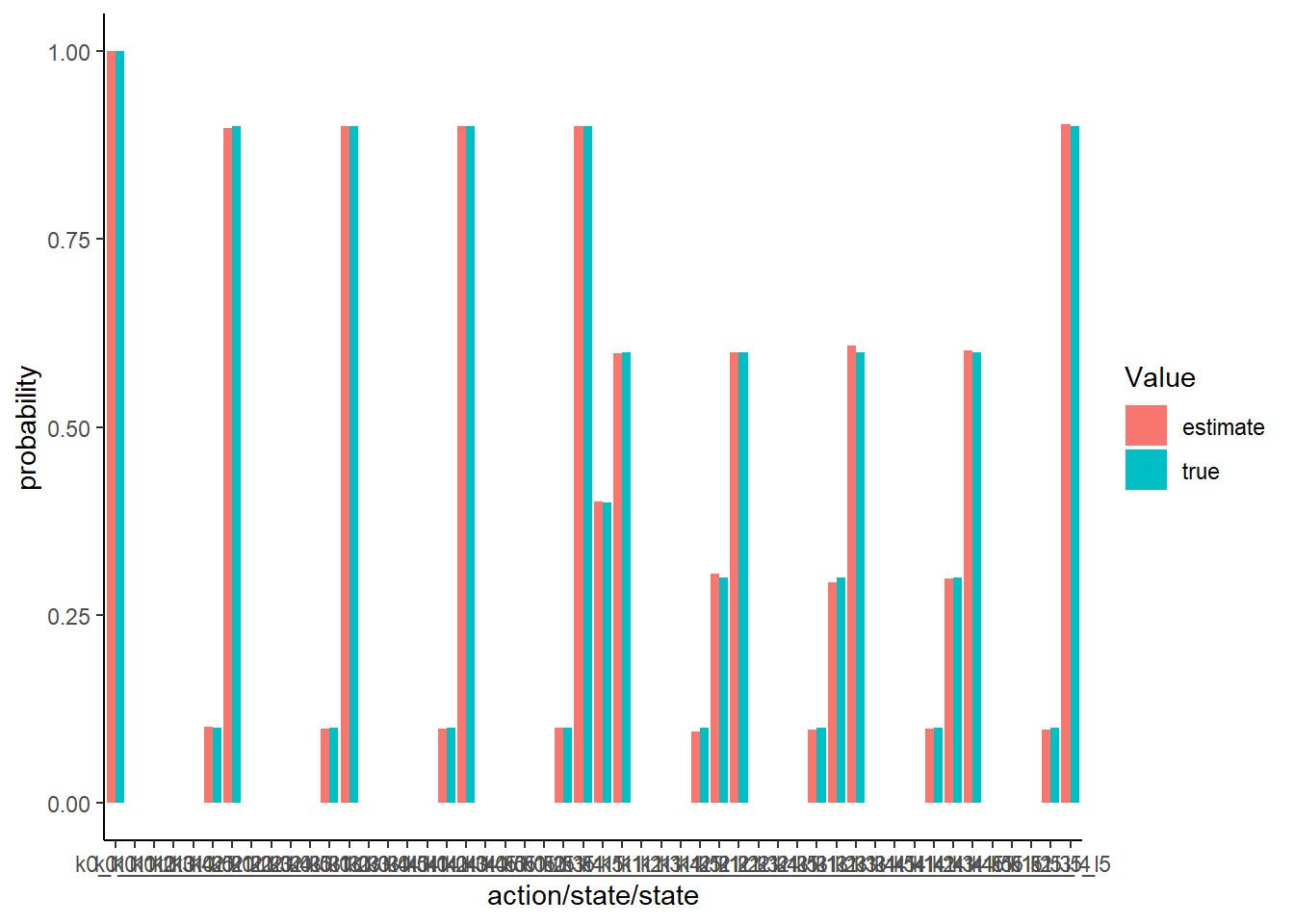

estimate_G_marginal(df)that returns a non-parametric estimate of the marginal transition probability matrix. Compare the estimated transition matrix and the true transition matrix by a bar plot.

# non-parametrically estimate individual transition probability

G_marginal_est <-

estimate_G_marginal(df = df)

check_G <-

data.frame(

type = "true",

reshape2::melt(G_marginal)

)

check_G_est <-

data.frame(

type = "estimate",

reshape2::melt(G_marginal_est)

)

check_G <-

rbind(

check_G,

check_G_est

)

check_G$variable <-

paste(

check_G$Var1,

check_G$Var2,

sep = "_"

)

ggplot(

data = check_G,

aes(

x = variable,

y = value,

fill = type

)

) +

geom_bar(

stat = "identity",

position = "dodge"

) +

labs(fill = "Value") +

xlab("action/state/state") +

ylab("probability") +

theme(axis.text.x = element_blank()) +

theme_classic()

18.2 Estimate parameters

- Vectorize the parameters as follows:

We estimate the parameters by a CCP approach.

- Write a function

estimate_theta_2_game(df)that returns the estimates of \(\kappa\) and \(\gamma\) directly from data by counting relevant events.

## [1] 0.09946371 0.60228274The objective function of the minimum distance estimator based on the conditional choice probability approach is: \[ \frac{1}{N K m_s} \sum_{i = 1}^N \sum_{l = 1}^{m_s} \sum_{k = 1}^{K}\{\hat{p}_i(a_k|s_l) - p_i^{(\theta_1, \theta_2)}(a_k|s_l)\}^2, \] where \(\hat{p}_i\) is the non-parametric estimate of the marginal conditional choice probability and \(p_i^{(\theta_1, \theta_2)}\) is the marginal conditional choice probability under parameters \(\theta_1\) and \(\theta_2\) given \(\hat{p}_i\). \(a_k\) is \(k\)-th action for a firm and \(s_l\) is \(l\)-th state profile.

- Write a function

compute_CCP_objective_game(theta_1, theta_2, p_est, L, K, delta)that returns the objective function of the above minimum distance estimator given a non-parametric estimate of the conditional choice probability and \(\theta_1\) and \(\theta_2\).

# compute the objective function of the minimum distance estimator based on the CCP approach

objective <-

compute_CCP_objective_game(

theta_1 = theta_1,

theta_2 = theta_2,

p_marginal_est = p_marginal_est,

A = A,

S = S,

delta = delta,

lambda = lambda

)

saveRDS(

objective,

file = "lecture/data/a8/objective.rds" %>% here::here()

)## [1] 0.0003285307- Check the value of the objective function around the true parameter.

# label

label <-

c(

"\\alpha",

"\\beta",

"\\eta"

)

label <-

paste(

"$",

label,

"$",

sep = ""

)

# compute the graph

graph <-

foreach (

i = 1:length(theta_1)

) %do% {

theta_i <- theta_1[i]

theta_i_list <-

theta_i * seq(

0.5,

2,

by = 0.2

)

objective_i <-

foreach (

j = 1:length(theta_i_list),

.combine = "rbind"

) %dopar% {

theta_ij <- theta_i_list[j]

theta_j <- theta_1

theta_j[i] <- theta_ij

objective_ij <-

compute_CCP_objective_game(

theta_j,

theta_2,

p_marginal_est,

A,

S,

delta,

lambda

)

return(objective_ij)

}

df_graph <-

data.frame(

x = theta_i_list,

y = objective_i

)

g <-

ggplot(

data = df_graph,

aes(

x = x,

y = y

)

) +

geom_point() +

geom_vline(

xintercept = theta_i,

linetype = "dotted"

) +

ylab("objective function") +

xlab(TeX(label[i])) +

theme_classic()

return(g)

}

saveRDS(

graph,

file = "lecture/data/a8/CCP_graph.rds" %>% here::here()

)## [[1]]

##

## [[2]]

##

## [[3]]

- Estimate the parameters by minimizing the objective function. To keep the model to be well-defined, impose an ad hoc lower and upper bounds such that \(\alpha \in [0, 1], \beta \in [0, 5], \delta \in [0, 1]\).

lower <-

rep(

0,

length(theta_1)

)

upper <- c(1, 5, 0.3)

CCP_result <-

optim(

par = theta_1,

fn = compute_CCP_objective_game,

method = "L-BFGS-B",

lower = lower,

upper = upper,

theta_2 = theta_2_est,

p_marginal_est = p_marginal_est,

A = A,

S = S,

delta = delta,

lambda = lambda

)

saveRDS(

CCP_result,

file = "lecture/data/a8/CCP_result.rds" %>% here::here()

)## $par

## [1] 1.0000000 2.0205947 0.2964074

##

## $value

## [1] 0.0003271323

##

## $counts

## function gradient

## 17 17

##

## $convergence

## [1] 0

##

## $message

## [1] "CONVERGENCE: REL_REDUCTION_OF_F <= FACTR*EPSMCH"## true estimate

## 1 1.0 1.0000000

## 2 2.0 2.0205947

## 3 0.3 0.2964074